Robert vt Hoenderdaal/iStock Editorial via Getty Images

The following segment was excerpted from this fund letter.

Basic-Fit (BSFFF)

Basic-Fit has been getting significant buzz lately, especially after it was featured in the Business Breakdown podcast (we promise our research started much before the podcast was released!).

Basic-Fit is the largest fitness chain in Europe with over 1000 clubs across Europe and over 2 million members, focusing on providing a low-cost and convenient gym experience. Researching Basic-Fit reminded us of the quintessential beginners to business example, where a single “lemonade stand” generates strong profits reinvested to create a chain for lemonade stands.

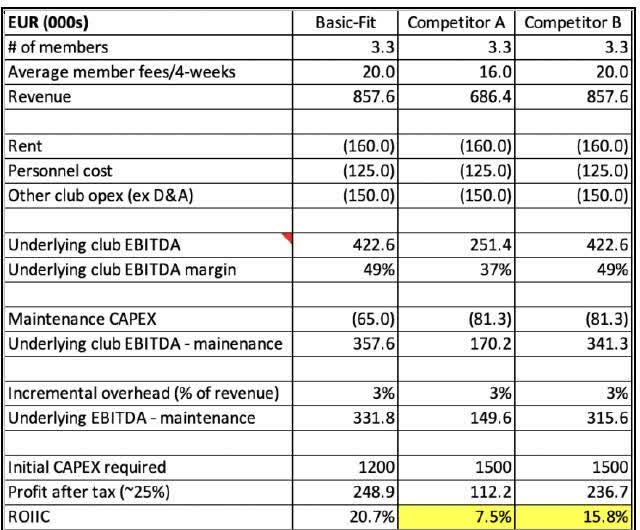

Similarly, the average Basic-Fit club has a post-tax ROIIC of 20%+ (our calculation), driven by a lean operating model of minimal staff per store, bulk equipment discounts due to scale, and an ability to spread market costs over several stores via their cluster strategy.

Basic-Fit is run by René Moos, a former professional tennis player, who started HealthCity in the Netherlands in 2004. What was originally a mid to premium gym concept merged evolved into Basic-Fit (via additional mergers and spinouts) which focused on the low-cost end of the market following the success of Planet Fitness in the US.

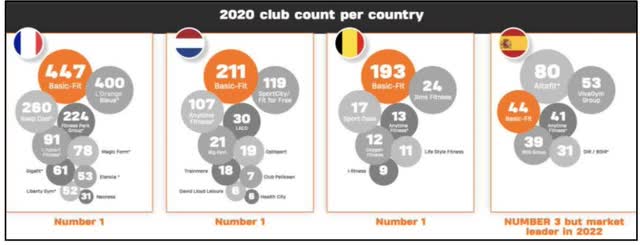

The company operates in France, Netherlands, Belgium, Spain, and now Germany. It has significant scale advantage over its competitors in most of its markets and is implementing an aggressive cluster strategy. This means opening several clubs in a particular region over a short period of time, increasing club accessibility for gym-goers.

We feel that this increase in accessibility will also increase gym-goer penetration in Europe which significantly lags that of the US (8% vs 20%+). This has been proven via real examples of Basic-Fit entering markets and increasing gym-goer penetration in the cluster (so not only taking a share but also growing the pie).

When we spoke to the company one of the big questions we had was why any of their competitors can’t copy them – and the company admitted that what they are doing is not rocket science. But after further conversation with the company, other investors, as well as our internal discussion, we came to two conclusions.

For one, an aggressive expansion strategy (goal is to reach 3000+ clubs by 2030) takes a few special ingredients

- solid execution

- access to capital and

- an aggressive but competent leader.

We feel Basic-Fit has all three.

Second, we feel that their scale just makes them hard to compete with.

In the chart below, you can see we compare a single Basic-Fit club with two hypothetical competitors’ clubs, first (Competitor A) who tries to compete on price and second (Competitor B) who tries to copy Basic-Fit exactly.

We assume similar rent/personnel cost/other OpEx (although due to its scale Basic-Fit does get discounts on rent in certain markets and because of the way its clubs are set up they can run on skeleton crews). We then build in advantages for maintenance capex and initial capex required because, according to industry experts, Basic-Fit enjoys at least a 30-40% discount versus mom-and-pop gyms and 20-25% discount versus other decent-sized players.

As one can see the ROIIC are significantly lower for both hypothetical competitors. So even if competitors arise (which is always a possibility) we doubt they will do nearly as well as Basic-Fit.

Now, investing in Basic-Fit carries certain risk. For one, the company has about Euro 550bn in net debt over an equity base of 410bn. Further, we think the company will need to borrow more over the next 3 years to meet their expansion goals of around 250-300 clubs per year. That said, we believe that despite the high level of debt, gearing ratios will actually decrease as clubs start to generate EBITDA post covid-closures.

Secondly, a lot of our internal IRR numbers (which are in the mid 25%) are based on the company hitting their 2025 goals of ~2000 clubs and 2030 goals of ~3000 clubs. What we’ve learned through the last few years is that a lot can happen between now and then.

Thus, we will scale into the position slowly as the company executes.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.