Europe’s automotive components trade association, CLEPA, says that the EU is losing out to the US in attracting foreign direct investment (FDI) in the global automotive supplier industry.

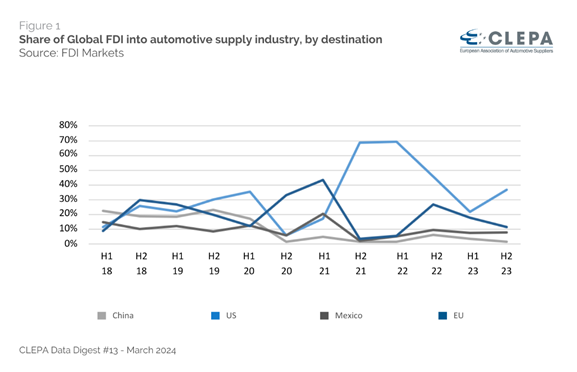

It says that, regarding FDI, the US has significantly outpaced the EU, attracting three times the amount of FDI over the past two and a half years. This discrepancy in investment, coupled with a higher rate of job cuts, falls notably short of the expectations set at the beginning of the decade, it says.

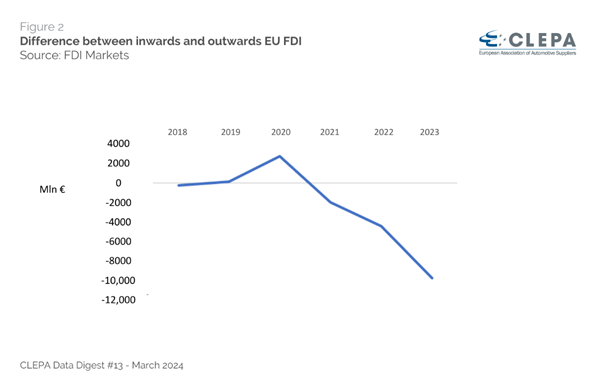

Moreover, CLEPA also says the decline in competitiveness is exacerbated by the growing imbalance between capital outflow and inflow. While the EU’s automotive suppliers continue to dominate FDI outside of their home markets, particularly in the US battery supply chain, inbound investments ‘no longer match Europe’s once formidable FDI prowess’.

The surplus of more than €2.5 billion in 2020 has dwindled to a deficit of nearly €10 billion in 2023, CLEPA says.

The trade association also says the postponement of investments in production equipment, plants, facilities and other capital goods is evident, illustrated by a ‘staggering €27 billion decrease in expected capital expenditure until 2029’.

Even more concerning, CLEPA says, is the failure of expected job growth to materialise in the industry. Since 2019, CLEPA maintains that nearly 118,000 jobs have been lost, while only 55,000 new positions have been created.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

“A rise in job losses and declining foreign direct investment are clear warning signs for the future automotive industry and calls for a new industrial deal in Europe,” said Benjamin Krieger, CLEPA’s Secretary General.

Nils Poel, CLEPA’s Head of Market Affairs, said: “EU suppliers continue to invest significantly in the green and digital transformation. However, this investment increasingly takes place outside of the EU. This not only affects the automotive industry, but also industries that depend on it, from steel to chemicals and the semiconductor sector.”

According to CLEPA figures, since H2 of 2022, the EU has experienced a 15.2 percentage point decrease in its share of global automotive supplier FDI, while the US’s share has been rising. Since H2 of 2021, FDI into the US has reached €65.2 billion – almost three times the amount entering the EU (€20.2 billion) over the same period.

Job losses

CLEPA said 2023 was a difficult year for employment in the automotive supply industry. The loss of 14,429 jobs was only met with the creation of some 10,500 jobs, and 2024 is continuing the downward trend. In the first two months of this year, CLEPA estimates a loss of 12,153 jobs was announced, primarily due to internal restructuring, while only 100 jobs have been created, leaving no sign of reversing this trend.

Since 2019, nearly 118,000 jobs have been lost, and only 55,000 new positions have been created. Beginning in H2 of 2023, the rate of net job creation has stayed negative.

Forecasts from 2021 suggested a net job creation of 101,000 by 2025, driven by electrification and a stricter Euro 7 regulation. However, job losses in the last 5 years currently outnumber job creation by more than 60,000 jobs, according to CLEPA.

Europe’s auto industry is facing a major competitive challenge from Chinese OEMs such as BYD who are targeting the market with cheap BEVs. This week, Renault CEO Luca de Meo called for a more collaborative approach from Europe’s automotive sector: Renault chief calls for cooperation to renew Europe’s auto industry