Alongside the report’s launch, SolarPower Europe has called for the European Union (EU) to adopt a comprehensive energy storage strategy and a 200GW by 2030 deployment target which it said would fully unlock solar PV growth potential in the bloc.

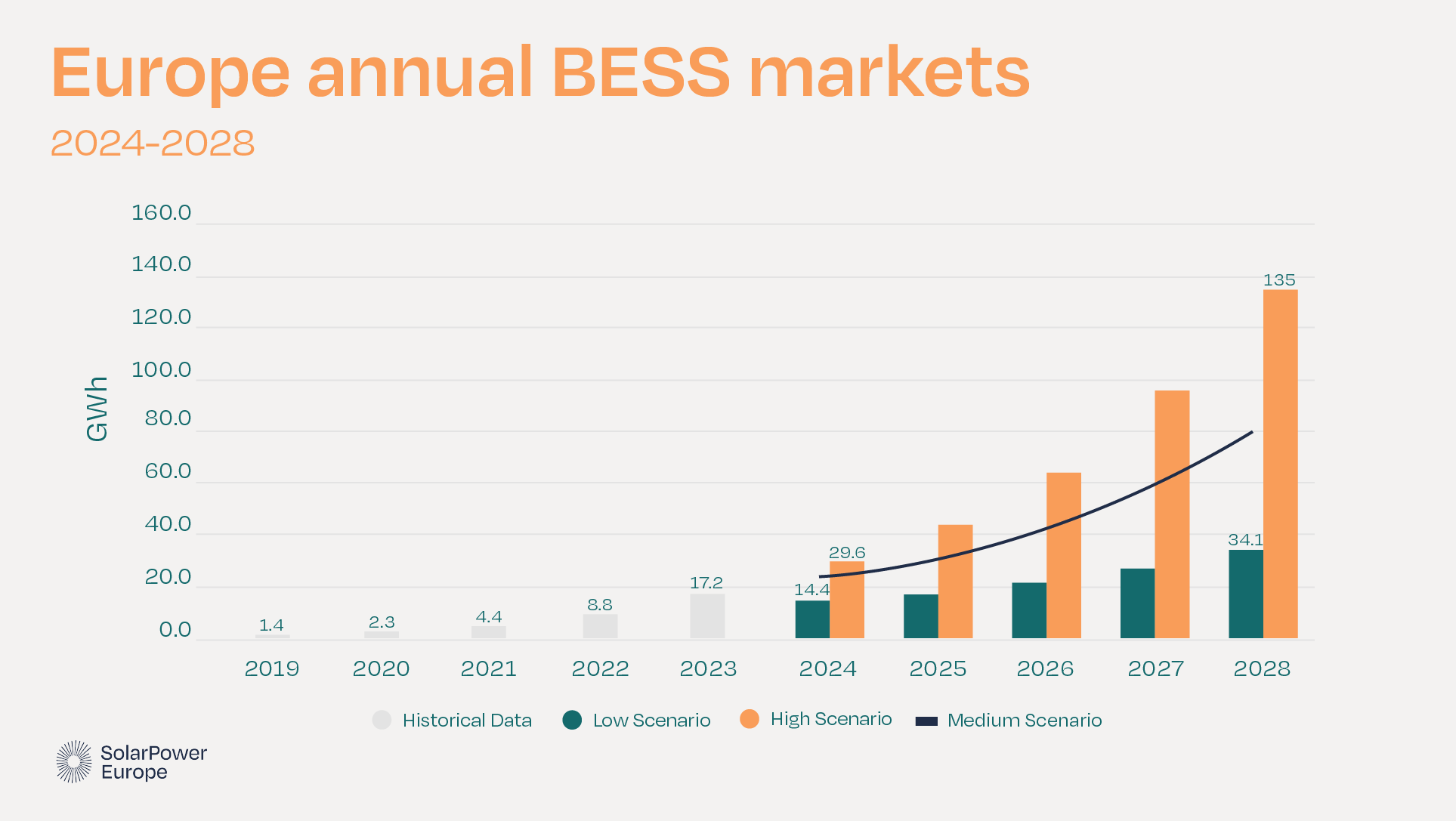

The association’s analysis found that 17.2GWh of battery energy storage system (BESS) installations were made in 2023, a 94% year-on-year increase from 2022, after a similar percentage increase the previous year. Looking back at a decade of data, it is a far cry from 2014 when Europe-wide deployments totalled just 150MWh for the year.

In fact, the market has doubled or close to doubled in size now for three consecutive years, and the total fleet across Europe represented 35.9GWh of energy storage capacity by the end of 2023.

Nonetheless, this lagged behind the global pace of deployment, with Europe accounting for just 15% of all worldwide additions, which grew by 133% last year by contrast.

SolarPower Europe said that with around 40% of energy consumption across the continent being met by renewable energy sources, battery storage is increasingly becoming the most crucial tool for integrating renewables on the grid.

However, realistic assessments of the need across Europe are lacking, as are supportive policies and market environments that would enable the deployment of around 200GW of battery storage, which SolarPower Europe estimated would be needed by 2030 in the European Union (EU) Member States alone to meet their agreed renewable energy goals.

The rapid growth seen in the past three years has been driven largely by private individuals as the Russia-Ukraine war sparked an energy price crisis and fears over security of supply, combined with falling costs of battery storage technologies over the past decade.

SolarPower Europe predicted a slowdown in growth over the next three years, forecasting growth rates in the range of 30% to 40% annually between 2025 and 2028, and it is now the turn of policymakers to support energy storage and its role in the energy transition, the trade group said.

“Growing battery storage and flexibility represents a fundamental shift from our current grid-centric view of the market. It impacts not only the way we plan infrastructure and the way we operate the system, but also the markets we engage with,” SolarPower Europe CEO Walburga Hemetsburger said, adding that EU Electricity Market Design (EMD) reforms which would set Member States targets for adding flexibility to their grids must be implemented as soon as possible.

“The new Electricity Market Design (EMD) legislation lays the groundwork for a more robust energy policy,” Hemetsburger said.

“We need to urgently implement these measures and call on the European Commission to report on the EMD implementation ahead of the first Energy Council in 2025.”

‘EU needs comprehensive electricity storage strategy’

In a report published in March, consultancy LCP Delta and the European Association for Storage of Energy (EASE) similarly found annual installations had roughly doubled from 2023 to 2023.

However, with that report, the European Market Monitor on Energy Storage (EMMES) 7.0, giving its figures in gigawatt terms (power) rather than gigawatt-hours (energy) as SolarPower Europe’s did, direct comparisons are difficult.

EMMES 7.0 gave the total installed figure for 2023 at 10.1GW, making it the first time Europe’s storage installations on a GW-basis outpaced the US, which according to Wood Mackenzie totalled 8.7GW at all scales last year.

Both LCP Delta-EASE and SolarPower Europe’s reports converge on a takeaway that the residential sector in Europe far outpaces utility-scale and commercial and industrial (C&I) scale for storage adoption.

Around 70% of installed capacity came from home storage systems, about 21% from large-scale or utility systems and the remaining 9% in the C&I space, according to SolarPower Europe.

Many of those residential batteries were installed in Germany, the overall market leader in Europe with 5.9GWh of total deployments across all scales representing a 152% increase, while Italy was second with 3.7GWh (86% growth) and the UK, for a long time the leader due to its utility-scale front-of-the-meter (FTM) market slipping to third with 2.7GWh of installations, although it had a similarly big jump in deployments of 91%.

Although the EU has been seen to gradually recognise that it won’t get to its climate neutral target by 2050 without energy storage, more still needs to be done, the trade association said, echoing a recent call by its storage counterpart EASE.

The 60-page SolarPower Europe report, launched in the wake of the EU elections and ahead of Europe’s biggest solar and storage trade events, Intersolar Europe and ees Europe next week in Germany, is a call to action for policymakers as well as industry and regulators.

“While policymakers have focused on batteries for electrifying the automotive industry, their critical role in the green transition of the European power system has been largely overlooked. Flexibility through battery storage isn’t solely a technical matter for regulators and standardisation bodies; it demands immediate political attention and prioritisation,” SolarPower Europe director of market intelligence Michael Schmela said.

“The growth of renewables is reliant on the adoption of clean flexibility sources like batteries, essential for transportation and heating electrification, as well as grid modernisation. SolarPower Europe is calling for a comprehensive EU electricity storage strategy and a target of 200 GW by 2030.”