Mercedes, BMW, Tesla, and Stellantis all recorded fewer registrations than last year, while Toyota and VW grew

1 hour ago

- European new car sales dropped 3 percent in May 2024 compared to the same time last year.

- EV sales were down by 12.5 percent, while hybrid registrations grew.

- Toyota and Volkswagen’s sales grew, while Mercedes, Stellantis, Renault, and Tesla all faltered.

A drop in new car sales in Europe is being blamed on the still high prices of EV offerings. According to the industry association ACEA, new registrations dropped by 3 percent in the month of May, with three out of four of the leading markets recording a downturn.

New car registrations in Italy fell by 6.6 percent, 4.3 percent in Germany, and 2.9 percent in France. Spain managed to buck the trend, with an increase of 3.4 percent. While the year-to-date figures increased by 4.6 percent, with 4.6 million vehicles registered. Analysts say that a downturn in EV sales is to blame for the short-term drop in registrations.

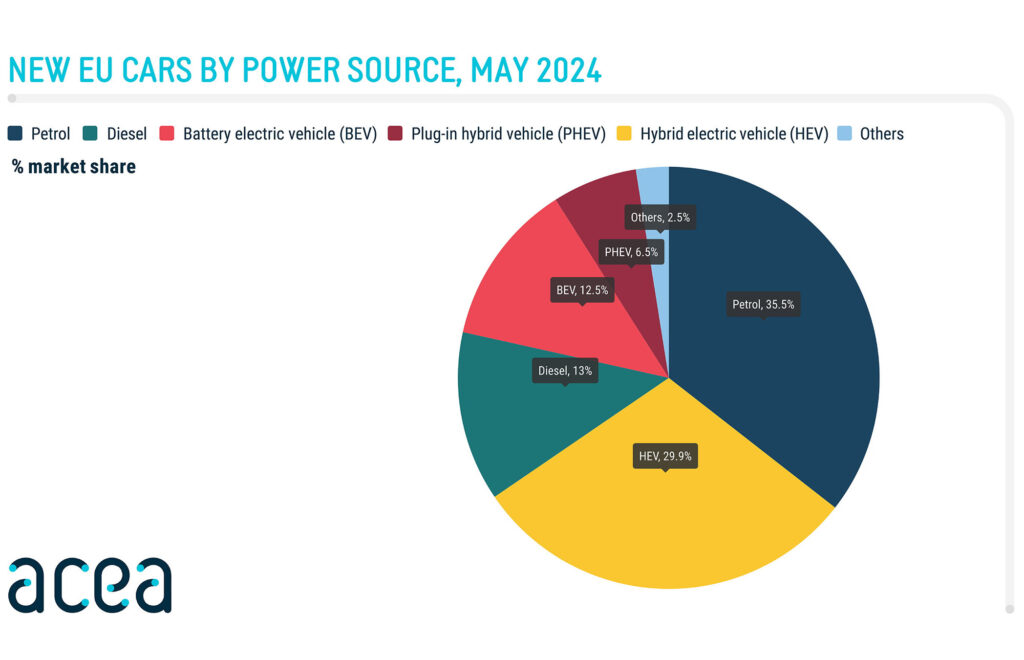

Sales By Powertrain — EVs And ICE Down, Hybrids Up

The overall market share for EVs in the EU fell to 12.5 percent in May 2024, compared to 13.8 percent in May 2023. While there was an overall drop for the EU as a whole, Belgium recorded strong EV growth, with a 44.8 percent increase in EV registrations.

In contrast, most of Europe reported fewer EVs entering their roads. Proposed tariffs of up to 38.8 percent on Chinese-origin EVs imported to the EU could further impact these results when they come into effect.

Read: German EV Sales Crater 31% In May, Tesla Says Hold My Beer

Germany, the EU’s largest EV market, unexpectedly ended subsidies in December. The result was a 16 percent drop in electric car sales for the first five months of the year compared with the same period in 2023. Month-to-date figures fell by 30.6 percent.

Petrol and diesel combustion-powered cars also saw a decline, with their combined share dipping from 52.1 percent to 48.5 percent. Petrol-powered cars are still the most popular in the market, with 323,551 units registered in May 2024.

Hybrid electric vehicles (not including PHEVS) benefitted from the drop in EV demand, increasing their market share from 25 percent to an impressive 29.9 percent. They represent the second-largest number of new car registrations by powertrain in the EU, with 272,568 units.

Plug-in hybrid cars saw major declines, with sales in Belgium and France reporting big drops by 36.6 percent and 19.4 percent, respectively. They accounted for only 6.5 percent of total vehicles sold in the EU last month, down from 7.4 percent in May 2023.

Mercedes And Stellantis Rethink Strategy While Tesla Shows Another Poor Showing

Waning demand for EVs has resulted in many major brands readjusting their EV targets. The high price of EVs continues to make the majority of them luxury purchases, which is hindered by the region’s inflation and high interest rates.

Read: Tesla Offers €6,000 “Environmental Discount” In Germany After Sales Tank 64% In May

Mercedes decided to halt the development of its MB.EA platform for future large EVs as a response to cooling demand. Additionally, the three-pointed star decided to keep ICE-powered cars in its lineup for longer than originally anticipated, with its latest expectations that the company will continue to sell them into the 2030s.

In a similar vein, work was stopped at Stellantis and Mercedes’ joint battery compound, which features sites in both Germany and Italy. Stellantis boss Carlos Tavares said that, while the company remains committed to BEVs, it will continue offering customers other powertrains.

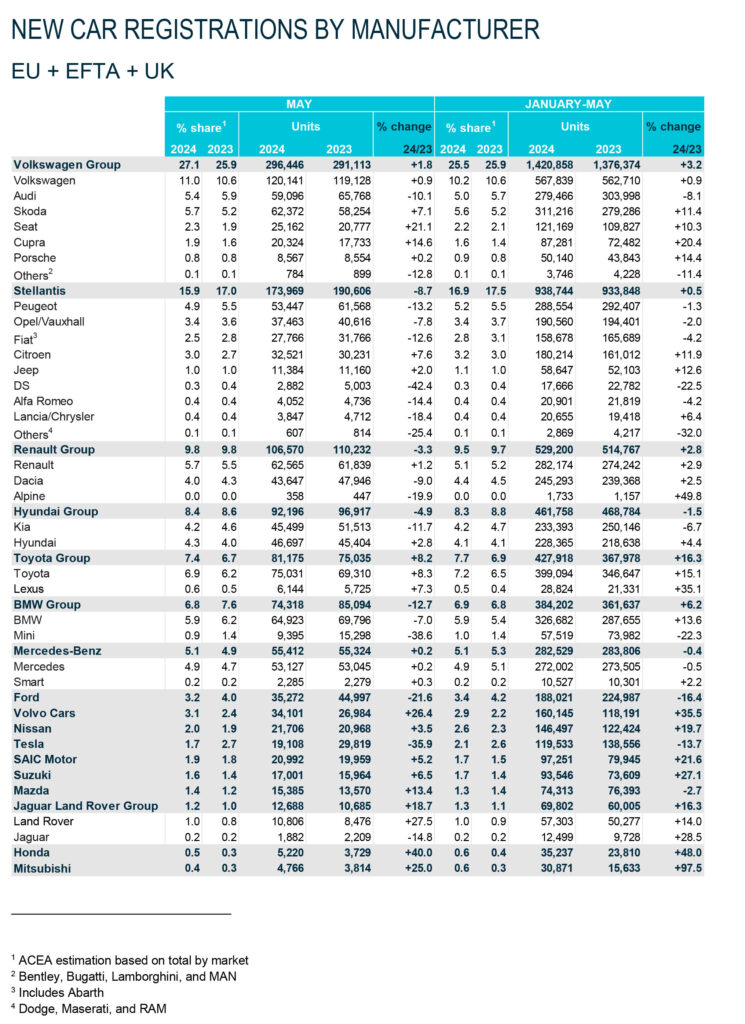

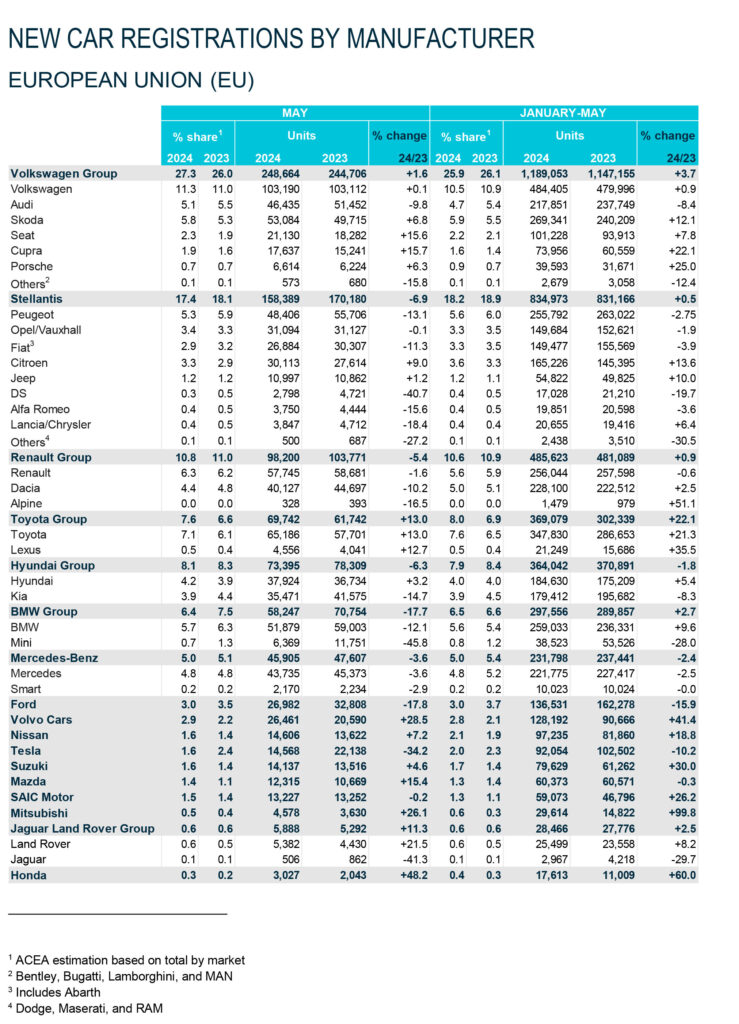

Mercedes’ European sales were down by 3.6 percent in May 2024, while most manufacturers continued to struggle. BMW sales fell by 17.7 percent, Stellantis by 6.9 percent, and the Renault Group by 5.4 percent.

Toyota was the big winner among mainstream carmakers, with their products (comprising Toyota and Lexus) growing in sales by 13 percent. Volkswagen also managed to report growth of 1.6 percent too.

Tesla’s registrations declined by 34.2 percent in May 2024, a trend that has seen a 10.2 percent dip in registrations for the first five months of the year. Their poor showing in Q2 is expected to worsen as the company expects to increase prices of Chinese-made Model 3s due to additional tariffs.