(Bloomberg) — The hierarchy of European sovereign debt markets is being reordered as a flareup in French political risk puts the nation’s bonds on par with those once at the heart of the region’s debt crisis.

Most Read from Bloomberg

French bonds, traditionally considered one of the safest assets in the euro area, sold off so sharply since President Emmanuel Macron called snap elections on Sunday that some now yield more than debt from Portugal and just a handful of basis points less than those issued by Spain.

For European bond veterans, it’s remarkable the bloc’s second-largest economy and a market heavyweight is now on an equal footing with economies that are lower-rated — and were so indebted they once threatened to bring down the euro zone. At the peak of the crisis more than a decade ago, Portuguese 10-year bonds yielded around 14 percentage points over French debt.

“This was a healthy reminder that politics and the fiscal outlook still matter,” said Jan von Gerich, chief analyst at Nordea. “Political risks seemed to have been almost forgotten in the euro bond markets.”

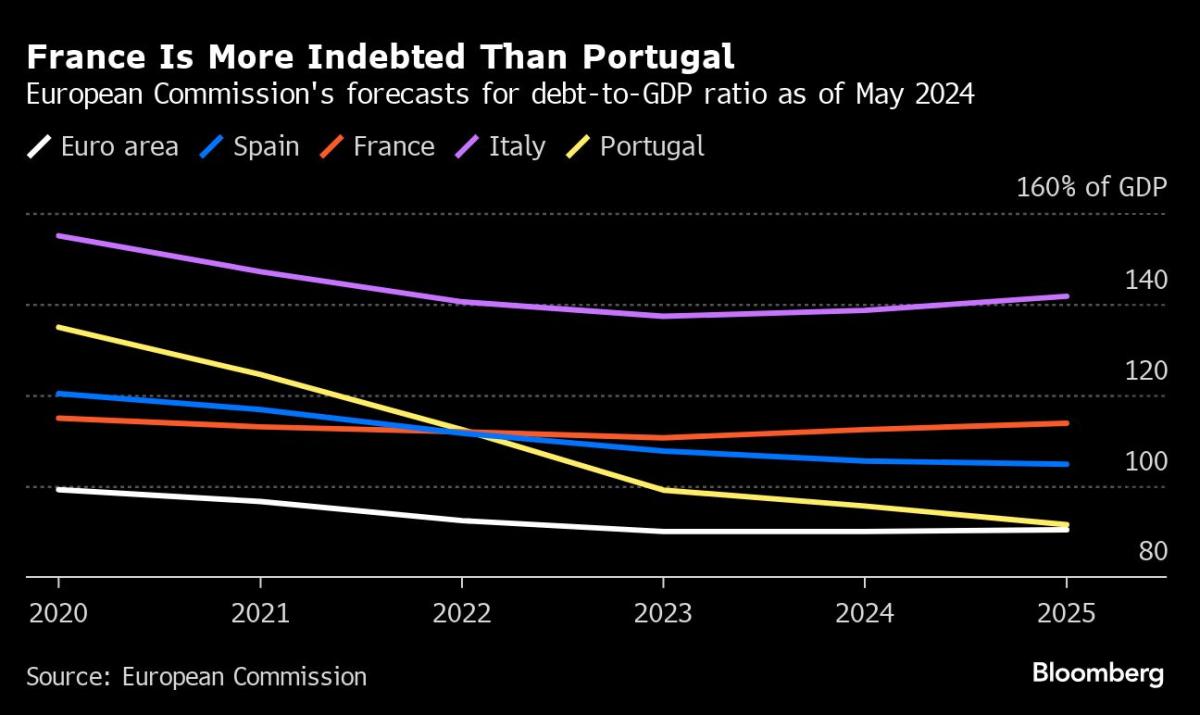

The repricing partly speaks to the outperformance of Europe’s peripheral nations in recent years, which have shrunk their debt load and reformed their sclerotic economies into some of the euro area’s fastest growing. It’s also a reminder that even today, advanced economies are not beyond the reproach of markets.

The rout was compounded Tuesday after a report that Macron was preparing to resign. While it was quickly denied — a stance that Macron himself reiterated in a press conference on Wednesday — the selloff spread to other markets, and at one point Italy’s yield premium over Germany rose 11 basis points.

French bonds made modest gains on Wednesday, mirroring the move in other European bond markets. The spread over German paper, the region’s safest asset, was steady at 61 basis points after blowing out to 66 basis points on Tuesday, the widest since March 2020.

The French president’s decision to call a snap vote on Sunday was a bid to block Marine Le Pen’s path to power after his party suffered a crushing defeat in European parliamentary elections. His gambit has rattled investors who are now raising questions about already stretched public finances and the future of his pro-business agenda.

What Bloomberg’s Strategists Say…

“Given the impending parliamentary elections in France and what that might bring, traders have little incentive to buy back the nation’s bonds anytime soon. In many ways, the saga of French debt distress may have, in fact, just begun.”

— Ven Ram, strategist

Click here for more

The vote risks becoming the ultimate showdown over his trademark economic policies, which had largely reassured investors and businesses since he took office in 2017. The worry is that if Macron loses control over parliament and the government, shoring up French government finances will become even more difficult.

Macron Won’t Quit If His Party Is Beaten in French Election

S&P Global Ratings last month downgraded the nation’s credit score, saying the deficit will remain above 3% of gross domestic product through 2027. Moody’s Corporation said in a note Monday that snap election increases the risks to plans to plug the holes in the budget.

Meanwhile, Portugal has made strides in reducing its debt as a percentage of GDP and is on track to cut it further to 91.5% through 2025, according to European Commission projections. In contrast, France’s debt-to-GDP ratio is seen climbing to 113.8% next year, up from 112.4% in 2024.

On Tuesday, France’s 10-year yield spread versus Spain compressed to the tightest since the financial crisis. Against Portugal, some French bonds are already yielding more. For instance, a Portuguese bond maturing in 2032 yielded 3.04% on Wednesday, versus 3.09% on French debt maturing a couple months earlier.

“There is some underlying uncertainty on whether this is the new norm in terms of the political environment,” said Daniel Loughney, head of fixed income at Mediolanum International Funds Ltd. Still, the jury is out on what the “implications there might be for other countries, especially Italy, which have benefited from the more stable political backdrop,” he said.

–With assistance from Sujata Rao.

(Updates prices throughout, additional context in paragraph six.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.