Science|Business – Table.Media partnershipScience|Business has partnered with Table.Media, a leading source of news about higher education and research in Germany. Each week, we are publishing one of each other’s stories to give readers an even broader range of insight into R&D policy across Europe. |

European companies collaborate with Chinese firms and file joint patents for their developments. Especially in telecommunications, information technology, and electronics, such co-patents exist, as revealed by a recent study of the EU project Reconnect China. This programme aims to determine in which areas collaboration between the European Union and China is “desirable, possible or impossible”.

The ultimate goal is to enhance Europe’s China expertise, even in specialized fields. The urgency of this goal was recently highlighted by a paper issued by the German Academic Exchange Service (DAAD), which criticizes a concerning decline in collaborations and mobility between Germany and China.

The authors are not providing recommendations for companies working on co-patents with China; their primary target audience is the scientific community. They consider the data and insights generated in their study as a potentially important foundation for further analyses by science and business.

Germany’s companies largest patent partners in Europe

To gain insight into joint patent projects, the authors combed through application entries in the PATSTAT database of the European Patent Office from 2011 to 2022. They sought joint patent applications by legal entities – including the inventors themselves or their companies – from China and the EU, including the UK, Norway and Switzerland (EU-27/AC). They found exactly 12,415 matching patent applications.

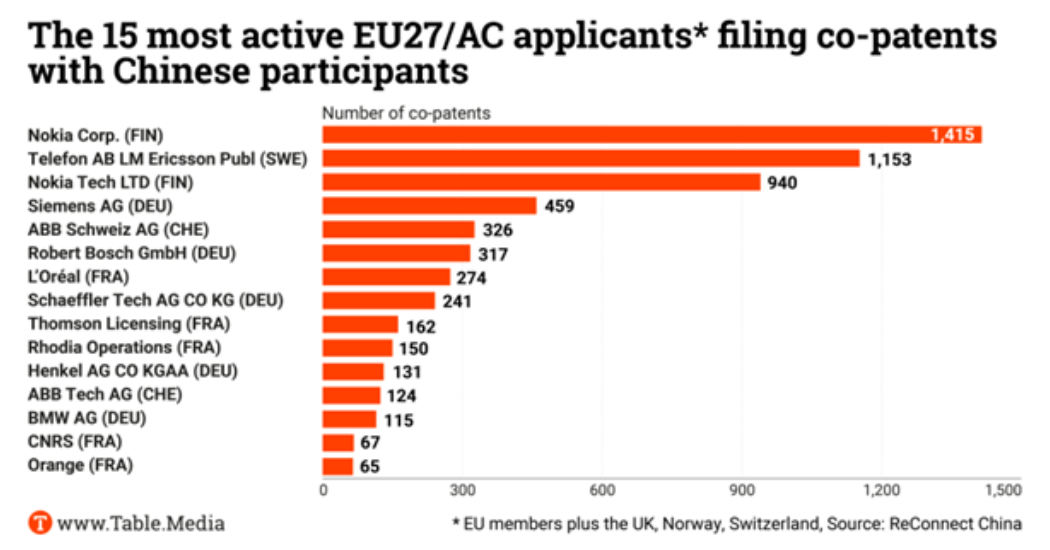

“Among the countries, Germany is the largest patent partner for China in Europe, followed by Finland, Sweden and France,” says co-author Philipp Brugner to Table.Media. “This is also reflected in the origin of the companies involved.” Nokia from Finland leads the pack, followed by Ericsson, a Nokia subsidiary, Siemens, ABB, Bosch and L’Oréal. All of them are major corporations.

This shows that “joint patenting between the EU27/AC and China is primarily a commercial endeavor dominated by the telecommunications/electronics industry and industrial heavyweights from Germany and France,” according to the study. A notable exception is the French state-supported research institute Centre National de la Recherche Scientifique (CNRS) with 67 co-patent applications with Chinese institutions in PATSTAT.

China actively engages with major companies and subsidiaries of Western corporations

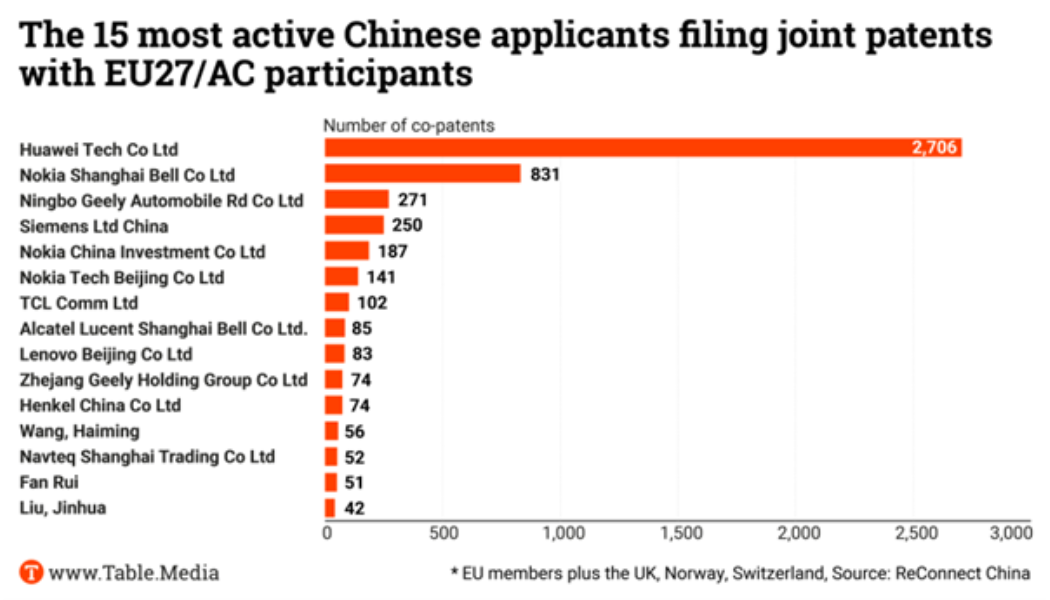

On the Chinese side, the situation is different. “Several of the most active applicants are Chinese subsidiaries of the European companies mentioned above,” write the authors. For example, Nokia Finland jointly files co-patents with its own Chinese subsidiaries. The Shanghai subsidiary of the US company NAVTEQ is also active. But “real” Chinese companies like Huawei, Lenovo, TCL or Geely are also strongly represented in co-patents. “It is noteworthy that all top 15 applicants from China are large companies.” Telecommunications and the electronics sector are also most strongly represented in China.

In general, access to innovations through patents is considered “secondary innovation”, where “technologies are not imported to copy, but to understand and fundamentally improve through one or more of their own development steps,” explains Brugner.

An example of how China has used this is in green technologies, where China initially relied on foreign products and facilities, such as wind turbines or photovoltaics. “Today, China is not only the main producer but also one of the strongest innovators in green technologies, as we could see from the share of internationally registered patents for these technologies.”

Co-patents: applicants and inventors

PATSTAT distinguishes between applicants and inventors in entries. Applicants are individuals or organizations who file a patent – and the future patent holder. Inventors are the minds behind an innovation and thus the creators of intellectual property. Chinese inventors can work, for example, in a Finnish company that applies for a patent for their idea.

A little more than half of the found co-patents (57.5 percent) contain at least one Chinese applicant. 71.2 percent contain at least one Chinese inventor. A subset of co-patents involves both Chinese inventors and applicants.

This is how the Chinese partners are distributed in the EU-27/AC states, according to the study:

- Applicants: Germany (20.4 percent), Finland (15.4 percent), Sweden (10.8 percent), France (9.8 percent) and Switzerland (6.4 percent) are the most important locations for European applicants for the found co-patents. Eastern European and Baltic countries are hardly active.

- Inventors: Germany (28.6 percent) and Sweden (12.7 percent) lead the list.

Co-patent analysis: difficult data situation

The data situation for patent analysis is quite challenging, according to the study. “From filing a patent application to its publication in the PATSTAT database, an average of about two years elapse,” it says. For this reason, many applications from 2018 are not yet included in PATSTAT. Until 2018, the number of jointly filed patents had been steadily increasing. Due to the lack of data, it drops after that. However, the authors assume that the number of jointly filed patents has continued to rise in 2021 and 2022, “as the interest of China in Europe is great,” as Brugner says.

“I believe that we can see the same trend as with joint publications: Cooperation with China regarding artificial intelligence and digital technologies is becoming increasingly important,” says co-author Gábor Szüdi. “And with co-patents, we primarily see a focus on very concrete applied science.” China is very interested in cooperation in this field.

Germany leads in co-patents at patent offices

Another problem makes the list incomplete: Not every patent office lists the country of the applicants or the patent office where it is filed. As a result, many co-patents in PATSTAT fall through the researchers’ grid, simply because they are not recognizable as such. “The Chinese Patent Office is one of the most prominent examples of this negligence,” the study says. “We worked with the best currently available data. But I am not sure if these give the whole picture,” says Szüdi.

Among the national patent offices, based on the available data, Germany (5.6 percent), the United Kingdom (3.3 percent) and France (2.1 percent) are the most important filing authorities for co-patents, according to the study. There are practically no co-patents at the Chinese Patent Office in the available data – possibly only because the authority simply did not enter this data.

This text appeared for the first time on 24 January 2024 in Research.Table, a professional briefing from the largest independent start-up for quality journalism in Germany. The editorial team reports for the key people in the research scene who set and fill the framework for science, research and development.