Annabelle Chih / Bloomberg / Getty Images

Jensen Huang, co-founder and chief executive officer of Nvidia Corp., speaks during an event in Taipei, Taiwan, on Sunday, June 2, 2024.

Key Takeaways

-

Nvidia shares continued to rise on Thursday, extending the AI chipmaker’s lead on Microsoft, which it overtook as the world’s most valuable company on Tuesday.

-

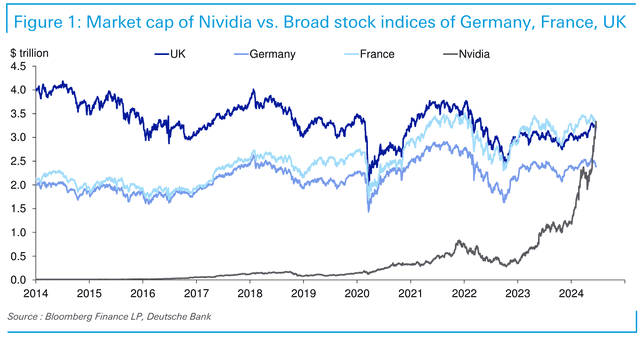

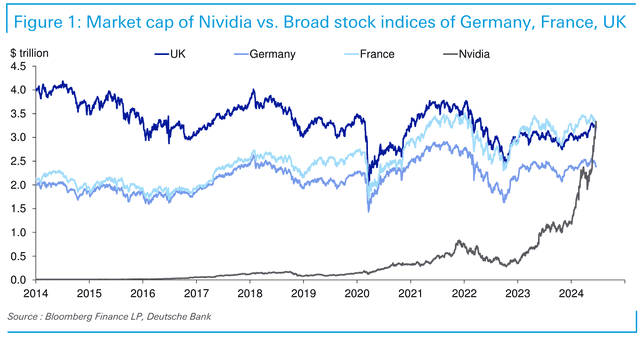

Nvidia’s soaring market cap has, in recent weeks, come to exceed that of the entire German, French, and U.K. stock markets, respectively.

-

Bank of America analysts see the potential for near-term volatility as investors take profits, but expect the company’s solid fundamentals and attractive valuation to support the stock long-term.

Nvidia (NVDA) shares continued to rise on Thursday, extending the AI chipmaker’s lead on Microsoft (MSFT), which it overtook as the world’s most valuable company on Tuesday.

Nvidia’s rise in the ranks of the world’s largest companies has been meteoric to say the least. Its market value has already doubled this year, after tripling last year. It has added $1 trillion in market capitalization—more than Warren Buffett’s storied Berkshire Hathaway (BRK.B), in the 23 trading days since May 20, according to a Deutsche Bank note distributed Thursday morning.

And with a market capitalization of more than $3.4 trillion, Nvidia has in recent weeks become larger than the respective stock markets of Germany, France, and the U.K. The only countries with national stock markets worth more than Nvidia as of Thursday were India, Japan, China, and, of course, the U.S.

Given how quickly the stock has climbed, it’s reasonable to expect some profit-taking in the near term, Bank of America Securities analysts said in a note Thursday. Volatility could be short-lived, they wrote, however, because of the company’s solid fundamentals and relatively attractive valuation.

We’re still in the early phases of the AI hardware deployment, the analysts said, and Nvidia should benefit from solid demand as it rolls out its next-gen Blackwell system later this year. Plus, Nvidia currently trades at about 30x price-to-earnings in Bank of America’s bull case—not that much higher than the entire S&P 500’s P/E ratio of 23.6 and in line with the Nasdaq 100’s ratio of 31.7.

Shares of Nvidia were up 1.5% at $137.58 in late-morning trading Thursday.

Read the original article on Investopedia.