1. Returned textiles in Europe

The textiles industry is an important sector for the EU and the global economy. In 2022, the EU textile and clothing sector returned to its pre-COVID-19 pandemic level with a turnover of EUR 167 billion, an increase of 14% compared to 2021. The EU textiles and clothing sector employs 1.3 million people across 192,000 companies (EURATEX, 2023b).

In 2022, households in the EU spent around EUR 282 billion on clothing, an average of EUR 630 per capita, and EUR 68 billion on footwear, which in total and in current prices is an increase of 15% over the previous year (Eurostat, 2023a).

The percentage of textile and clothing sold online was 11% in 2020, more than double the amount in 2009 when it was 5% (EURATEX, 2023b). Clothing (including sportswear), shoes and/or accessories is by far the most popular category of physical products purchased online in the EU. Items in this category were ordered by 68% of internet shoppers in 2022.

Figure 1 shows a steady increase in the percentage of individuals who purchased clothes and shoes online between 2020 and 2022. Those aged 16-44 years made up the highest share of individuals purchasing online (up to 76%). However, the increase in the online purchasing of clothing and shoes is greater for those between 45 and 74 years old (Eurostat, 2023b).

Figure 1. Share of individuals in the EU who purchased clothes, shoes and accessories online, 2020-2022

Source: Eurostat, 2023b.

Click here for different chart formats and data

In the EU, consumers that have bought a product or service online have the right to cancel and return their order within 14 days without justification. For products bought in a shop, there is no EU legal right of return of goods for exchange or refund unless the item is faulty. However, many shops voluntarily allow customers to return or exchange goods during a certain time period (EU, 2023; Nestler et al., 2021).

Box 1. Definition of return rates

The return rate refers to the number of purchased items that are returned in relation to the total number of items sold. Return rates for fashion and lifestyle products are significantly higher than those observed for other product categories. The inability to closely inspect or touch and feel products before purchase, combined with significant sizing variations between brands, make apparel and footwear especially prone to high return rates. 70% of returns are caused by buyer-perceived poor fit or style (Zomer and van Kempen, 2019; WHY5 research, 2021; Ader et al., 2021; Nestler et al., 2021).

The return rate for products sold online is up to three times higher than for products sold in physical stores (Roland Berger et al., 2023; Graat, 2018). With the growth of online sales, return rates have also increased (Nestler et al., 2021; Roland Berger et al., 2023).

Among online shoppers in the EU, 14% state that they have returned an item in the last month (Postnord, 2022; DPD Group, 2022). Micro-to-small web shops have a significantly lower return rate than medium-to-large web shops (WHY5, 2021). Overall, young adults (18-24 years) have the highest product return rate (Statista, 2021; Postnord, 2022). The return rates are lower for each successive age group.

Overall, in Europe, the average return rate for clothing is estimated at 20% — one out of every five pieces of clothing is returned. Online product returns for footwear range between 22% and 37% (Gustafsson et al., 2021; Asdecker et al., 2021). Overall, the average return rate for footwear in the EU is estimated at 30%. Winter shoes and boots are the most returned footwear product category.

An analysis of more than 1,000 records of returned items from Galaxus, the largest Swiss online retailer, also indicates that higher priced products are more likely to be returned. Within a product category, higher priced brands/products were found to have a higher return rate than the average return rate of that product category.

Product return processes are complex, usually span different locations and can take weeks to complete. This complexity has a significant impact on resale potential — especially for seasonal and fast fashion products — and could lead to significant reductions of the original selling price (markdowns). The costs of handling returns are substantial. These could include costs for logistics, sorting and handling returns, replacements or refunds, customer care and asset depreciation for markdowns, liquidation or destruction (Frei et al., 2022; Ader et al., 2021; Roland Berger et al., 2023). Many retailers are unaware of the true costs of returns. According to a study by The British Fashion Council’s Institute of Positive Fashion, it costs a retailer approximately 55% to 75% of a product’s retail price to process each online return. This is mainly due to the high number of labour-intensive steps (Roland Berger et al., 2023).

There are various destinations for returned products. In the best case they are restocked and sold again at full price (so-called ‘A grade’). However, for various reasons (e.g. minor defects, end of line and out of season or style) some items can only be resold at reduced prices. Products that cannot be resold at all are either donated to charity, liquidated or sold to middlemen (often referred to as ‘jobbers’) or are destroyed. However, some products that are restocked or go to secondary markets can still end up being destroyed (Makov et al., 2023). We look at destruction in detail in Section 3.

Options to promote reduced returns

For companies, optimising the return strategy is key to reducing the amount of (excessive) returns. This can be achieved through the implementation of strategies such as avoiding and gatekeeping returns (Frei et al., 2020).

Avoidance of returns strategy: Companies can take several actions to avoid returns even before items are sold. Conveying accurate product descriptions and providing size advice are key processes for reducing returns. According to a large online European retailer, for items for which they offer size advice — using size indications and size recommendations — size-related returns have fallen by 10% compared to items that did not have size advice. More sophisticated size advice could be provided by digital fitting technologies, for instance, by customers taking a picture of themselves with their smartphones to create personalised measurements. Consumers can be encouraged to use size charts when provided and to be more selective about what they order.

Gatekeeping returns strategy: Limiting returns through initiatives at the point of return can also reduce them. This gatekeeping strategy includes raising awareness about the economic, environmental and climate costs associated with returns and not providing free returns on purchases made online (Frei et al., 2020). Although EU rules provide consumers with the right to cancel and return products or services purchased online within 14 days of an order, they also state that the seller can charge for the return and/or not cover the shipping costs of the return, as long as this is clearly stated at the time of purchase (EU, 2011, 2023). Additionally, offering free returns up to 30, 50 or even more days after a purchase has a significant impact on resale potential (Roland Berger et al., 2023; Frei et al., 2022; Ader et al., 2021). Limiting the return period can therefore have a positive impact on the probability of selling an eventual return.

Despite the above arguments, returns are not fundamentally the issue. Allowing for returns is important to ensure that customers only buy what is necessary, fits and will be used, and to allow the garment to be sold to someone else.

2. Unsold textiles in Europe

In addition to large volumes of returned products from online sales discussed above, there are also large volumes of unsold textiles in Europe. These textiles are neither sold online nor in physical shops. Unsold textiles are often due to rapidly changing fashion and the many new designs put on the market throughout a year.

Box 2. Definition of unsold products

Unsold products can be either overstocks (products that are produced but have never been sold), obsolete products (products for which there is no longer any demand) or products that are damaged or recalled by their manufacturer because of quality issues (Roberts et al., 2022). Overstock and obsolete products are the result of a mismatch between what is produced and demanded. This mismatch can be due to difficulty in forecasting, market dynamics and a conscious business strategy.

The textiles and fashion industry, particularly fast fashion, is characterised by a large variety of goods produced. This characteristic is also called product diversification in terms of styles, colours and sizes, as well as differences between seasons (Elia, 2019; Tanaka et al., 2019). From a consumer’s perspective, this diversity provides options and more freedom of choice. However, the more diverse the portfolio of products, styles, colours and sizes, the harder it is to correctly predict how much of each will sell within a current season. These difficulties in forecasting could result in overstock, for example, when a brand orders more products of a certain colour, which turns out to be not as popular as expected or when a trend changes before products are sold, making them obsolete. Sales of seasonal items such as winter coats are affected by the weather conditions of that season.

Large geographical variations in consumption also make sales challenging to predict. For physical stores, the challenge of forecasting is aggravated by physical conditions. Every store has limited storage capacity and this is particularly true for smaller retailers. Therefore, stores cannot accept all products at once and need to remove unsold goods to make space for the next collection (Tanaka et al., 2019).

Brands, especially those in the fast fashion sector, often prefer overstock to reduce lead time and avoid the risk of not being able to meet demand and generate the related profit (Roberts et al., 2022).

The majority of labour-intensive clothing production takes place in the global South, mostly in Asia, where low-wages are prevalent (Dzhengiz et al., 2023), making it more advantageous to produce too much rather than lose potential sales (Roberts et al., 2022). This is further aggravated because of economies of scale and scope. Economies of scale refers to the fact that it is generally cheaper per product to produce more pieces of one product due to efficiency gains, whereas economies of scope refers to the fact that it is often cheaper on average per product when you also produce a variety of closely related products (Investopedia, 2023b). Consequently, not only is a diverse portfolio on average less costly to produce, having a high product diversification and producing large quantities is less costly on average per product than producing smaller quantities and fewer types of products (Singh et al., 2019; Roberts et al., 2022). This situation then leads to the overproduction of product types, styles, colours and sizes.

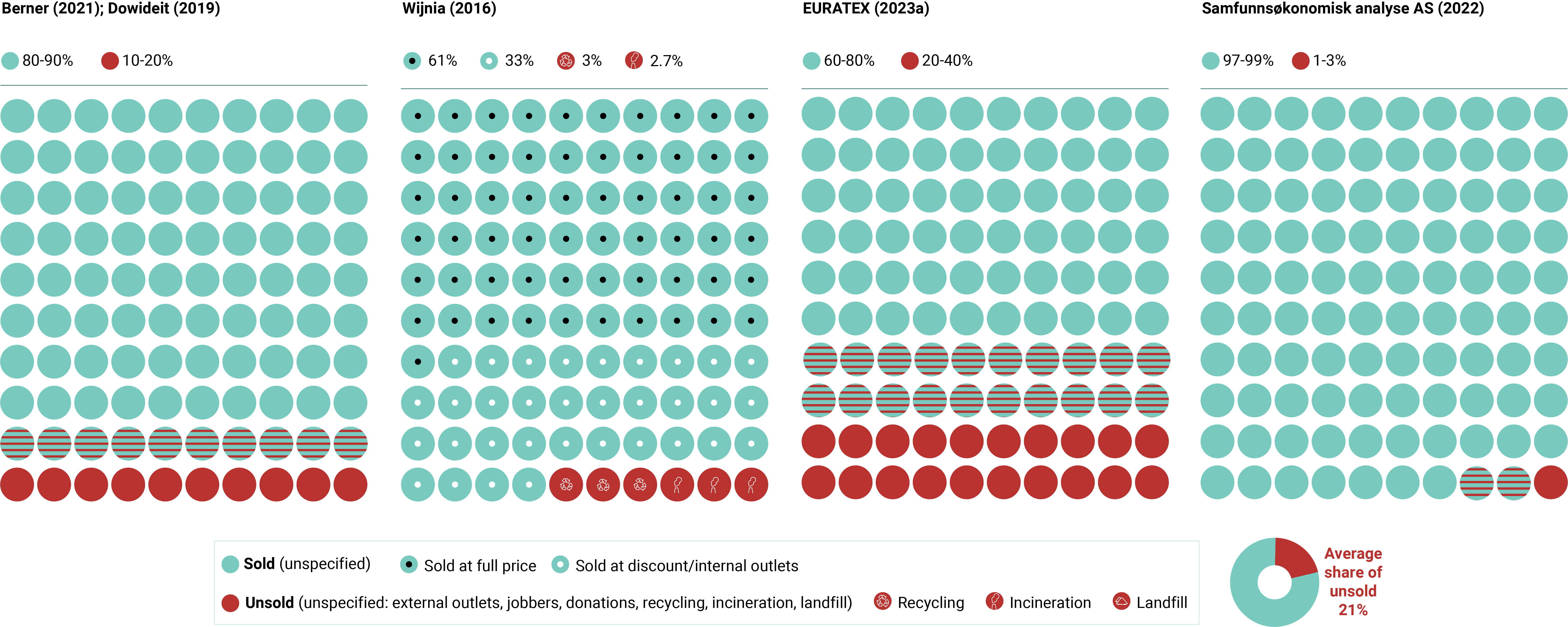

There is little information available about the volume of textile products that are not sold. Few companies report on the volume of unsold goods and the numbers that exist are based on companies’ own reporting and lack transparency. Figure 2 shows that the numbers are rather divergent between different countries, years, studies and sources. Overall, the average share of unsold textile products found in available sources is 21%.

Figure 2. Share of unsold textiles according to available sources

Sources: (a) Berner (2021); Dowideit (2019); (b) Wijnia, 2016; (c) EURATEX, 2023a; (d) Samfunnsøkonomisk analyse AS, 2022.

Click here for different chart formats and data

Options to reduce the share of unsold textiles

The volume of unsold textiles through overstocks and obsolete products could be reduced by increasing the accuracy of forecasting and improved inventory management. It could also be reduced by optimising the process of ordering, storing, using and selling a company’s raw materials, components and finished goods (Investopedia, 2023a).

3. Destruction of returned and unsold textiles in Europe

Open data and transparency regarding the handling of returned and unsold textile products in Europe is currently lacking; the overall size and impact of textile product destruction remains uncertain. The practice of destroying returned and unsold clothing and other textiles has been happening in the fashion industry since at least the 1980s (Napier and Sanguineti, 2020).

Table 1. Glossary of products subject to product destruction

| Term | Description | |

| Returned products | Products that have been sold but have been returned by the customer to the retailer under their right to return. These products may be fully functional or damaged. | |

| Unsold | Overstock | Products that are produced but have never been sold. These products come straight from the production line. |

| Obsolete products | Products for which there is no longer any demand. | |

| Damaged products | Products that have been damaged in transit or storage. | |

| Recalled/ defective products | Products taken off the market due to a defect or quality issues. | |

Source: Adapted from Roberts et al., 2023.

Box 3. Definition of destruction of textiles

In this briefing, the EEA considers the destruction of returned or unsold products as the discarding or intentional damaging of these products after which they become waste. As such, recycling is considered destruction, given the need to, for example, shred or dismantle products for this purpose. Considering recycling, incineration and landfilling of returned or unsold products as destruction also corresponds to how product destruction is defined in the Ecodesign for Sustainable Products Regulation (ESPR) proposal and regulation, i.e. products that are destroyed without ever being used for their intended purpose (EC, 2022). Roberts et al. (2023) also define product destruction as ‘a situation whereby consumer products are willingly disposed of before use’.

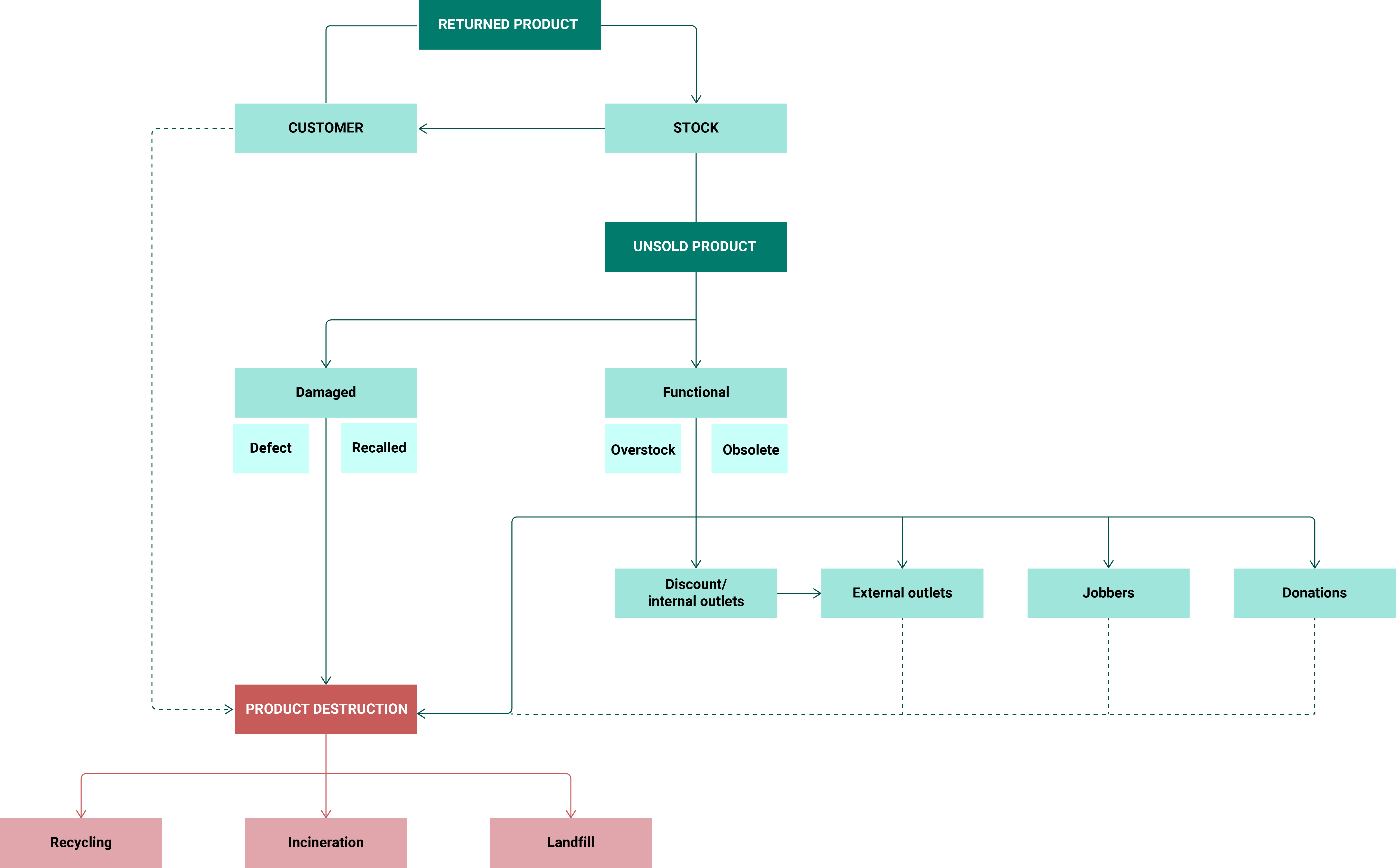

Figure 3 illustrates the different types of products, how the different terms relate and how they are addressed.

Figure 3. Different types of products and product flows for returned and unsold textiles

Source: Developed by ETC CE.

Figure 4 shows the calculated proportion of textiles that is destroyed out of the total volume of online sales and the total volume of products put on the market (stock) based on available data. As products sold online are part of products put on the market, there is a partial overlap in the data. This is because it is unclear what proportion of the unsold products are returned products. From the available data, it can be estimated that 4-9% of all textile products put on the market are destroyed without ever being used for their intended purpose.

Figure 4. Proportion of textile products destroyed

Note: Under returns, the ‘best practices’ scenario is a scenario in which all returned items undergo advanced grading and are carefully assessed according to defined criteria.

Sources: (a) Makov et al., 2023; (b) EURATEX, 2023b; Samfunnsøkonomisk analyse AS, 2022; ADEME, 2021; Watson et al., 2020.

The destruction of customer returns and unsold textiles have direct environmental and climate impacts. These arise from the processes of handling returns and unsold textiles, and the destruction itself. Importantly, there are also indirect impacts from their original production, even if they are never used.

Customer returns lead to a range of processes, which all imply resource and energy consumption — i.e., repackaging, transport, sorting, grading and other activities related to returns — and the use of space, which requires heating and light (Frei et al., 2020). The distance returned goods travel could be well above 1,000km due to consolidation centres, advanced grading and restocking locations being spread over different countries (Makov et al., 2023). However, only 3% of the environmentally harmful emissions from textiles come from distribution and retail (EEA, 2022). This means that the additional transport and other activities involved in the return process need to be significant if their emissions are to surpass those from producing a new product.

Unsold textiles are associated with direct and indirect environmental and climate impacts. These impacts include energy use related to storage and the additional transport at the end of a sales period when overstocks are returned to warehouses, from where they are often transported again to be sold at discount through other channels or to be discarded (Tanaka et al., 2019). Lastly, destruction in the form of incineration not only releases CO2, but also other air pollutants, depending on how technically advanced the incineration is (Elia, 2019). Unsold textiles have significant negative environment and climate impacts from the resource use, production and transportation of textiles products that are never consumed but end up being destroyed.

A large share of unsold products is ultimately exported out of Europe. The majority of these end up in Africa and Asia, aimed for reuse or recycling (ETC CE, 2023). In Africa there are, however, signs that a large portion ends up as waste, mostly in open landfills, or is incinerated in open air, releasing toxins directly without filtering (ETC CE, 2023).

The estimates of the climate impact of the destruction of unsold products can be based on the mass of textiles destroyed multiplied by the environmental impact of producing 1kg of new textiles. First, the mass of textiles destroyed is calculated based on the total amount of apparent consumption (production + import – export) of textile products in the EU in 2020, amounting to 6.6 million tonnes (EEA, 2022), and the total share of destruction of the total mass of online sales and the total mass of products put on the market (stock), which ranges between 4% and 9%. This estimate amounted to a range of 264,000 tonnes to 594,000 tonnes of textiles destroyed in 2020.

Estimates of the climate impact of the destruction of these textiles is calculated based on the greenhouse gas (GHG) emissions from textile production that originate from fibre production. This varies between 0.5kg and 9.5kg CO2-equivalent per kg of fibre (EEA, 2022). The GHG impacts of the consecutive steps in the production process — spinning, weaving or knitting, dyeing, confection and finishing — are not included.

This rather significant range is because different fibres and fibre production have large differences in GHG emissions. Including both extremes shows that using an average would at best be misleading. The range of emissions is combined with the range of estimations of volumes of textiles destroyed. The lowest GHG emissions, combined with the lowest share of destruction, gives an estimate of 132,000kg CO2-equivalent per kg of fibre. Conversely, at the highest estimated share of destruction, combined with the highest possible GHG emissions, the destruction is responsible for 5.6 million tonnes CO2-equivalent. This is comparable to the emissions of just over one million petrol cars driving for one year (US EPA, 2015) or slightly lower than Sweden’s net emissions in 2021. In reality, the estimates are likely to be towards the higher end of the range presented as the range of GHG emissions does not take into account the production of garments, and the estimated share of destruction is likely to be an underestimation.

Reducing excessive returns and optimising forecasting could reduce the volumes of returned and unsold textiles but does not effectively tackle the underlying systemic reason, namely that overproduction and destruction is deemed acceptable in the textiles industry and even makes economic sense. This could be tackled through the introduction of policies.

Policy options for reducing returns and overproduction

To achieve an actual shift away from the large quantities of customer returns and unsold goods, both hard and soft policy interventions can be used. Hard policy instruments, such as laws and taxes, tend to act by restricting consumer choices and altering financial incentives, whereas soft policies typically include ‘moral persuasion’ and educational campaigns and more recently behavioural public policy approaches, including nudging (Banerjee et al., 2021). Overarchingly, policy interventions can potentially aim to increase the cost of production so that overproduction becomes a financial liability for brands, which would be more in their interest to avoid, while incentivising redistribution.

Box 4. An EU ban on destruction of unsold textiles and footwear

A key action proposed in the EU Strategy for Sustainable and Circular Textiles was to stop the destruction of unsold and returned textiles (EC, 2022).

On 5 December 2023, the Council of the European Union and the European Parliament reached a provisional political agreement on a proposed regulation establishing a framework for setting eco-design requirements for sustainable products (ESPR). The new regulation replaces the existing 2009 Ecodesign Directive and enlarges the scope beyond energy-related products to considerably enhance circularity, energy efficiency, resource effectiveness and other environmental sustainability aspects for particular product categories placed on the EU market. Article 20 of the proposed ESPR establishes a general obligation of transparency for economic operators who discard unsold consumer products, including disclosing information on the number of unsold consumer products discarded per year. The same article also opens up the possibility of adopting specific actions to prohibit the destruction of specific groups of unsold consumer products.

The EU’s co-legislators are deciding on a direct prohibition on the destruction of unsold textile products. Small and micro companies would be exempted from this ban, while medium-sized companies would benefit from a 6-year exemption. This ban would be applicable 2 years after the entry into force of the regulation (Council of the European Union, 2023).

Some proponents believe that forcing companies to publicly disclose the amount of unsold goods and returns will draw attention to the scale of the problem and indirectly force them to reduce their amounts (due to the danger of gaining an unwanted negative branding image) (Roberts et al., 2023).

The introduction of extended producer responsibility (EPR) systems for textiles across the EU is likely to enforce and enable moving unsold textiles up the waste hierarchy. The main purpose of an EPR scheme is to transfer the responsibility for waste management — collection and treatment — to the actors who put the products on the market.

With the new EU ban coming into force, the following years will reveal how effective the textiles industry will be in avoiding the destruction of returned and unsold textiles in Europe.

4. Other reading

The briefing is a continuation of the work on textiles in Europe’s circular economy by the European Environment Agency (EEA) and its European Topic Centre on Circular Economy and Resource Use (ETC CE). It started with the 2019 EEA briefing and underpinning ETC CE reports on textiles and the environment in a circular economy. These were followed by other reports and briefings, most recently the 2022 briefings and reports on design for circularity and microplastic from textiles consumption in Europe and the 2023 EEA briefings and ETC CE papers on exports of used textiles and bio-based textiles. Together, these briefings and reports help inform current knowledge on the transition to a circular textiles economy in the EU.

References

ADEME, 2021, Etude des gisements et des causes des invendus non alimentaires et de leurs voies d’écoulement (https://librairie.ademe.fr/dechets-economie-circulaire/5035-etude-des-gisements-et-des-causes-des-invendus-non-alimentaires-et-de-leurs-voies-d-ecoulement.html) accessed 12 May 2023.

Ader, J., et al., 2021, Returning to order: Improving returns management for apparel companies, McKinsey & Company (https://www.mckinsey.com/industries/retail/our-insights/returning-to-order-improving-returns-management-for-apparel-companies#/) accessed 8 March 2023.

Asdecker, B., et al., 2021, ‘Retourenmanagement als Erfolgsfaktor des Handels’, in: Schallmo, D. R. A. et al. (eds), Digitale Transformation von Geschäftsmodellen: Grundlagen, Instrumente und Best Practices, Schwerpunkt Business Model Innovation, Springer Fachmedien, Wiesbaden, pp. 605-622.

Banerjee, S., et al., 2021, ‘Public support for “soft” versus “hard” public policies: Review of the evidence’, Journal of Behavioral Public Administration4 (DOI: 10.30636/jbpa.42.220).

Berner, B., 2021, ‘Warum unverkaufte Textilien oft einfach weggeworfen werden’, tagesschau.de (https://www.tagesschau.de/wirtschaft/unternehmen/textilien-wegwerfen-101.html) accessed 28 February 2024.

Bodenheimer, M., et al., 2022, ‘Drivers and barriers to fashion rental for everyday garments: an empirical analysis of a former fashion-rental company’, Sustainability: Science, Practice and Policy 18(1), pp. 344-356 (DOI: 10.1080/15487733.2022.2065774).

Council of the European Union, 2023, ‘Products fit for the green transition: Council and Parliament conclude a provisional agreement on the Ecodesign regulation’ (https://www.consilium.europa.eu/en/press/press-releases/2023/12/05/products-fit-for-the-green-transition-council-and-parliament-conclude-a-provisional-agreement-on-the-ecodesign-regulation/).

Deutsche Welle, 2020, ‘Returned, as-new goods end up as trash – DW – 02/07/2020’, dw.com (https://www.dw.com/en/destroy-packages-online-shopping/a-52281567) accessed 9 June 2023.

Dowideit, A., 2019, ‘Bekleidung: Hunderte Millionen Textilien fabrikneu vernichtet’, DIE WELT, 10 November 2019 (https://www.welt.de/wirtschaft/article203216646/Bekleidung-Hunderte-Millionen-Textilien-fabrikneu-vernichtet.html) accessed 15 June 2023.

DPD Group, 2022, E-shopper barometer 2022.

Dzhengiz, T., et al., 2023, ‘(Un)Sustainable transitions towards fast and ultra-fast fashion’, Fashion and Textiles 10(1), p. 19 (DOI: 10.1186/s40691-023-00337-9).

EC, 2022, Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL establishing a framework for setting ecodesign requirements for sustainable products and repealing Directive 2009/125/EC.

EEA, 2022, ‘Textiles and the environment: the role of design in Europe’s circular economy’, European Environment Agency (https://www.eea.europa.eu/publications/textiles-and-the-environment-the/textiles-and-the-environment-the) accessed 9 May 2023.

Elia, A., 2019, ‘Fashion’s Destruction of Unsold Goods: Responsible Solutions for an Environmentally Conscious Future’, Fordham Intellectual Property, Media & Entertainment Law Journal 30, p. 539.

ETC CE, 2023, EU exports of used textiles in Europe’s circular economy, Eionet Report ETC/CE No 2023/4, European Topic Centre for Circular Economy and Resource Use (https://www.eionet.europa.eu/etcs/etc-ce/products/etc-ce-report-2023-4-eu-exports-of-used-textiles-in-europe2019s-circular-economy) accessed 12 April 2023.

ETC WMGE, 2021, Business Models in a Circular Economy, European Topic Centre on Waste and Materials in a Green Economy (https://www.eionet.europa.eu/etcs/etc-wmge/products/etc-wmge-reports/business-models-in-a-circular-economy) accessed 30 October 2023.

EU, 2011, Consolidated text: Directive 2011/83/EU of the European Parliament and of the Council of 25 October 2011 on consumer rights, amending Council Directive 93/13/EEC and Directive 1999/44/EC of the European Parliament and of the Council and repealing Council Directive 85/577/EEC and Directive 97/7/EC of the European Parliament and of the Council (Text with EEA relevance)Text with EEA relevance (OJ L 304 22.11.2011, p. 64)

EU, 2023, ‘Guarantees, cancelling and returning your purchases’, Your Europe (https://europa.eu/youreurope/citizens/consumers/shopping/guarantees-returns/index_en.htm) accessed 10 May 2023.

EURATEX, 2023a, Additional information provided to the draft ETC/CE report on ‘volumes and destruction of returned and unsold textiles in Europe’, The European Apparel and Textile Confederation.

EURATEX, 2023b, Facts & Key Figures 2022 of the European Textile and Clothing Industry, The European Apparel and Textile Confederation.

Eurostat, 2023a, ‘Final consumption expenditure of households by consumption purpose’ (https://ec.europa.eu/eurostat/databrowser/view/NAMA_10_CO3_P3__custom_6483685/default/table?lang=en) accessed 8 June 2023.

Eurostat, 2023b, ‘Internet purchases – goods or services (2020 onwards)’ (https://ec.europa.eu/eurostat/databrowser/view/ISOC_EC_IBGS__custom_6164488/default/table?lang=en) accessed 11 May 2023.

FashionUnited, 2017, ‘H&M accused of burning 12 tonnes of new, unsold clothing per year’, Fashion United (https://fashionunited.uk/news/fashion/h-m-accused-of-burning-12-tonnes-of-new-unsold-clothing-per-year/2017101726341) accessed 9 June 2023.

Frei, R., et al., 2020, ‘Sustainable reverse supply chains and circular economy in multichannel retail returns’, Business Strategy and the Environment 29(5), pp. 1925-1940 (DOI: 10.1002/bse.2479).

Frei, R., et al., 2022, ‘Mapping Product Returns Processes in Multichannel Retailing: Challenges and Opportunities’, Sustainability 14(3), p. 1382 (DOI: 10.3390/su14031382).

Galaxus, 2023, ‘Details on the warranty score and return rate’ (https://www.galaxus.de/en/wiki/6174) accessed 14 June 2023.

Graat, M., 2018, ‘All You Need to Know About e-Commerce Returns in Europe’, Logistics Matter (https://logisticsmatter.com/need-know-e-commerce-returns-europe/) accessed 14 June 2023.

Gustafsson, E., et al., 2021, ‘Reducing retail supply chain costs of product returns using digital product fitting’, International Journal of Physical Distribution & Logistics Management 51(8), pp. 877-896 (DOI: 10.1108/IJPDLM-10-2020-0334).

Hartley, K., et al., 2020, ‘Policies for transitioning towards a circular economy: Expectations from the European Union (EU)’, Resources, Conservation and Recycling 155, p. 104634 (DOI: 10.1016/j.resconrec.2019.104634).

Investopedia, 2023a, ‘Inventory Management Defined, Plus Methods and Techniques’, Investopedia (https://www.investopedia.com/terms/i/inventory-management.asp) accessed 12 June 2023.

Investopedia, 2023b, ‘Understanding Economies of Scope vs. Economies of Scale’, Investopedia (https://www.investopedia.com/ask/answers/042215/what-difference-between-economies-scope-and-economies-scale.asp) accessed 22 August 2023.

Makov, T., et al., 2023, The hidden costs on consumer product returns (https://www.researchsquare.com/article/rs-3355404/v1).

Napier, E. and Sanguineti, F., 2018, ‘Fashion Merchandisers’ Slash and Burn Dilemma: A Consequence of Over Production and Excessive Waste?’, Rutgers Business Review 3(2), pp. 159-174.

Nestler, A., et al., 2021, ‘SizeFlags: Reducing Size and Fit Related Returns in Fashion E-Commerce’, Proceedings of the 27th ACM SIGKDD Conference on Knowledge Discovery & Data Mining, New York, NY, USA, 14 August 2021.

Postnord, 2022, E-Barometer Q2 2022 (https://www.postnord.se/siteassets/pdf/rapporter/e-barometern-q2-report-2022.pdf).

Roberts, H., et al., 2023, ‘Product destruction: Exploring unsustainable production-consumption systems and appropriate policy responses’, Sustainable Production and Consumption35, pp. 300-312 (DOI: 10.1016/j.spc.2022.11.009).

Rödig, L., et al., 2021, Prohibiting-the-destruction-of-unsold-goods-Policy-brief-2021.pdf, European Environmental Bureau (https://eeb.org/wp-content/uploads/2021/10/Prohibiting-the-destruction-of-unsold-goods-Policy-brief-2021.pdf) accessed 6 February 2023.

Roland Berger, et al., 2023, Solving fashion’s product returns, The British Fashion Council’s Institute of Positive Fashion (https://instituteofpositivefashion.com/uploads/files/1/Report—Solving-fashion’s-product-returns-March-2023.pdf) accessed 20 April 2023.

Samfunnsøkonomisk analyse AS, 2022, Overskudd av klær fra klesbransjen i Norge, Samfunnsøkonomisk analyse AS.

Singh, P. K., et al., 2019, ‘Fashion Retail: Forecasting Demand for New Items’, arXiv (http://arxiv.org/abs/1907.01960) accessed 13 June 2023.

Statista, 2021, ‘Europe: leading product returners online 2021’, Statista (https://www.statista.com/statistics/1257082/average-return-rates-among-digital-shoppers-in-europe/) accessed 4 May 2023.

Tanaka, R., et al., 2019, ‘Determination of Shipping Timing in Logistics Warehouse Considering Shortage and Disposal in Textile Industry’, Procedia Manufacturing 39, pp. 1567-1576 (DOI: 10.1016/j.promfg.2020.01.285).

US EPA, 2015, ‘Greenhouse Gas Equivalencies Calculator’ (https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator) accessed 1 February 2024.

Watson, D., et al., 2020, Kartlegging av brukte tekstiler og tekstilavfall i Norge, Planmiljø.

WHY5, 2021, Belgian online sustainability barometer 2021, WHY5 Research (https://www.safeshops.be/app/uploads/2021/10/SAFE-21054_Safeshops-sustainability_report-25102021_compressed.pdf)

Wijnia, G., 2016, Mapping obsolete inventory in the Dutch apparel industry – A qualitative and quantitative analysis of discounted and unsold volumes in apparel, Wageningen University.

Zazzara, L., et al., 2020, Burberry Burning Backlash.

Zomer, G.R. and van Kempen, E.A., 2019, Get rid of returns.Analyse van retouren van online aankopen in fashion en schoenen en verkenning van oplossingsrichtingen, TNO en Topsector Logistiek.

Identifiers

Briefing no. 01/2024

Title: The destruction of returned and unsold textiles in Europe’s circular economy

EN HTML: TH-AM-24-004-EN-Q – ISBN: 978-92-9480-630-7 – ISSN: 2467-3196 – doi: 10.2800/752

EN PDF: TH-AM-24-004-EN-N – ISBN: 978-92-9480-631-4 – ISSN: 2467-3196 – doi: 10.2800/109430