Consumers around the world might be mistaken if they believe 2024 will offer a chance to catch their collective breath after enduring a post-pandemic period of turbulence. Universally, slowing growth, new and continued geopolitical conflict, and consumer spending pressures are likely to define economic prospects. And as in previous times, the impacts will likely not be felt uniformly as market responses diverge.

As 2023 rolls towards its end, forecasters have readjusted their outlooks as the strains of high inflation and subsequent interest rate hikes showed few signs of falling closer to target levels. By October, the International Monetary Fund’s forecast put global GDP growth at 2.9 percent in 2024, down from 3 percent in 2023 and 3.5 percent in 2022. The IMF cites slowdowns in advanced economies as the primary culprit.

Inflation, still remaining high, will likely continue to be in the limelight. According to the IMF, the global headline inflation rate is set to fall to 5.8 percent in 2024, from 6.9 percent in 2023 and 8.7 percent in 2022. Against this backdrop, officials at the US Federal Reserve Bank are among those at central banks who expect interest rates to remain “higher for longer.”

What will likely differentiate 2024 from the past few years is that consumers in key economies may be confronting different challenges from each other, thus creating additional complexity for fashion executives steering their companies through headwinds from region to region. In Europe, the economic picture is gloomy, as it continues to struggle under the shadow of the war in Ukraine. By the second quarter of 2023, Europe’s biggest economy, Germany, saw growth stagnate, and the risk of a second recession within a year is still hovering. Meanwhile, in the UK, Europe’s second largest economy, growth was slow as the economy attempted to shrug off 2022′s surge in inflation and adjust to 14 consecutive interest rate hikes.

GDP growth in the euro zone is set to remain low, seeing only a tentative rise in 2024 — from 0.7 percent in 2023 to 1.2 percent in 2024, according to the IMF. A monthly euro-zone survey by the European Commission found that consumer confidence hit a six-month low in September. The euro zone’s ongoing cost-of-living crisis is straining many households, alongside continued higher core inflation rates compared to the US.

In the US, where Federal Reserve policies appear to have averted outright recession and achieved lower levels of inflation, growth prospects seem slightly brighter than those in Europe. However, GDP growth is expected to slow next year, from 2.1 percent down to 1.5 percent.

Various events in the second half of 2023 underscored the fragility of consumer confidence in the country. For example, in October US policy makers lifted the three-year freeze on student-loan repayments, leaving 37 percent of respondents to a Morgan Stanley survey anticipating that they would have to cut spending in order to make payments, while 34 percent said they would not be able to make payments at all. Earlier in the year, credit card debt reached an all-time high of $1.03 trillion, according to central bank research, with high interest rates and financing charges also contributing to headwinds.

In China, 2023 held different economic pressures. The economy moved into deflation, and an ongoing crisis in the property market — which drives 25 percent of China’s economy — left apartment sales in August 47 percent below 2019 levels. Major property companies are buckling under the weight of unsustainable debts and losses. Youth unemployment has been high, hitting 20.8 percent in May (the latest date that China’s National Bureau of Statistics published new figures).

Chinese consumers have continued building up savings, while a return to spending has been slow. At around 35 percent to 45 percent of GDP, China’s gross savings rate has been historically high and, according to the World Bank, the country has the highest savings-to-GDP rate among large economies. Indicators suggest that in 2023, China’s savings levels increased further, perhaps as households expanded their safety nets out of precaution.

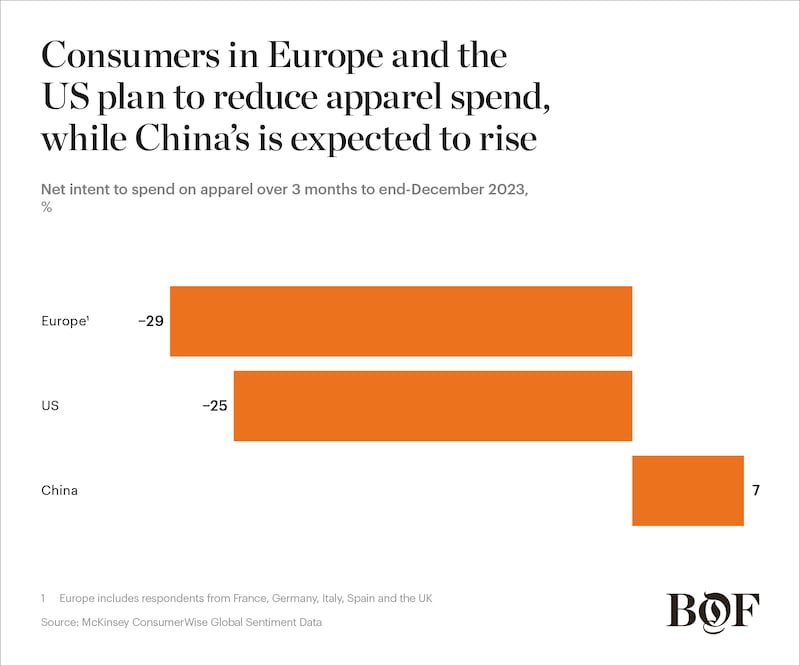

In contrast, savings pots have dwindled in both the US and Europe. An unusual amount of excess in savings was built up in these regions during the Covid-19 pandemic, but analysis now suggests that these are likely to run out by the end of 2023, after consumers returned to shopping more freely following the lifting of pandemic lockdowns. The subsequent toughening of the economic climate in 2023 has also meant that it is difficult for consumers to replenish their savings, and even as savings remain reasonably high in absolute terms, inflation is causing them to devalue. This bodes ill for discretionary spending in 2024, after recent years of relatively buoyant consumption. Pressure on household budgets is likely to prompt a decline in discretionary spend. In the third quarter of 2023, net intent to purchase apparel was negative 25 in the US and negative 29 in Europe, according to a McKinsey survey.

Rays of Light

Still, there are certain country-level reasons for some degree of optimism. This is the case with China, even if the base case is for muted demand and slow GDP growth, from 5 percent in 2023 to 4.2 percent in 2023, according to IMF forecasts. The volume of imports expanded 1 percent year on year in the first half of 2023 (compared with a decline of 6.4 percent in the same period in 2022), indicating a tentative rise in domestic demand.

Consumer spending plans in China appear to be marginally more positive than in the US and Europe, with a 7 percent net intent to purchase apparel as well as jewellery, and 8 percent for footwear, McKinsey research shows. Meanwhile, 69 percent of consumers are planning to splurge on shopping. However, even if cautious, optimism for the country should be tempered, as the overall outlook may be disappointing — forecasts for shopping and travel have remained dampened in recent months, and growth is still well below historical levels.

Emerging Asia provides potential, too. For example, in India, consumer confidence reached a four-year high in September 2023, while India-based executives are more optimistic than western peers, with 85 percent of respondents to a McKinsey global survey saying that conditions have improved in the six months to August. India’s bellwether manufacturing Purchasing Managers Index (PMI) hit a 31-month high in May and the services PMI reached a 13-year high in July. GDP growth stood at 6.9 percent in fiscal 2023. Strong investment activity, consistent domestic demand and a policy-maker push to invest in infrastructure buoyed the rapid growth. This rate will likely moderate in 2024 but remains strong with forecasted GDP growth of 6.3 percent.

The impact of 2024′s mixed outlook will be felt by fashion businesses across the value chain. Brands and retailers will likely need to confront a further wave of low consumer demand in some key markets, while suppliers may feel the amplified effects of this dampened demand even more as it echoes along the supply chain, leading to underutilised capacity. Revenue growth in this environment is likely to be driven by price rather than volume, and businesses will need to plan price increases with care and precision to avoid alienating cash-strapped consumers.

To build greater resilience across value chains in 2024, fashion decision makers can focus on contingency planning, ensuring that scenarios take into account high levels of uncertainty and the range of regionalised consumer demand shifts. Scenarios for each region will need to factor in increasingly divergent underlying factors. Meanwhile, strong inventory management is likely to remain a priority, continuing successful cost management programmes implemented in post-pandemic times.

Meanwhile, suppliers can expect an increasingly competitive landscape. Manufacturing sector price wars are a possibility as weak consumer demand puts pressure on orders and leads to excess capacity in some supply chains. Suppliers may want to work to build deeper, collaborative relationships with brands to reduce exposure to price competitiveness, while ensuring they retain tight control of costs in the year ahead.

This article first appeared in The State of Fashion 2024, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.